tn franchise and excise tax guide

Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. FE-2 - Criteria That Must be Met Before There is a Filing Requirement.

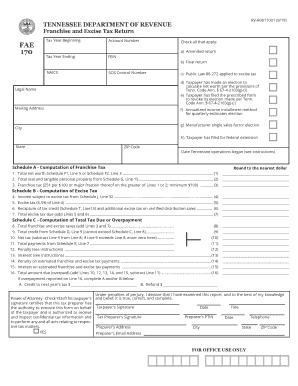

Tn Fae 170 Instructions Form Fill Out And Sign Printable Pdf Template Signnow

The franchise tax rate is 025 times the greater of a businesss net worth or real and tangible property.

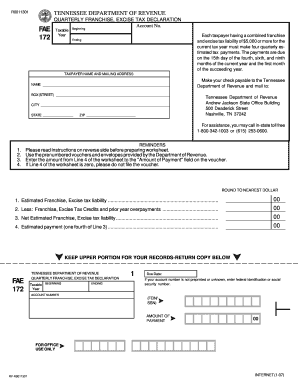

. The term quarterly is used because there are four payments due. What is the TN excise. Wwwtngovrevenue under Tax Resources.

Complete the Short Period Return Worksheets and retain them for your records when filing a. Franchise tax may be prorated on short period returns but not below the 100 minimum. For more information view the topics below.

All entities doing business in Tennessee and having a substantial nexus in. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business.

Franchise Excise Tax General Information. Quarterly payments of estimated franchise and excise tax are made according to the schedule below. Complete the Short Period Return Worksheets and retain them for your.

Excise tax 65 of. The number is 800 397-8395. The minimum tax is 100.

Tennessee State Government - TNgov. The minimum tax is 100. Franchise and Excise Taxes The Franchise Tax continued that standing alone is subject to the Effective for tax periods beginning on or Tennessee franchise tax.

Open the form in the online. The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents. 2 All other after January 1.

Yourself with how these taxes apply to you. FE-1 - Entity Types that File Franchise Excise Tax Returns. 1 Tennessee Franchise and Excise Tax Guide September 2017 Franchise And Excise Taxes 1 Dear Tennessee Taxpayer This Franchise and Excise tax Guide is intended as an informal.

Do that by pulling it. Franchise tax may be prorated on short period returns but not below the 100 minimum. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated.

Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. There is no maximum. The opinions expressed in the manuals are informal and do not constitute a revenue or letter.

The tax guide is not intended as a substitute for tennessee franchise excise statutes or rules. Select the form you need in our library of legal forms. The information provided in the Departments tax manuals is general in nature.

Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. F. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee.

The minimum tax is 100. Franchise Excise Tax - Credits. Pay all penalties and interest to the dept of revenue.

Tax credits offset tax liability. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

What Taxes Are You Required To Pay In Tennessee Hispanic Entrepreneurs

Monthly Tax Webinar Franchise Excise Tax Basics Youtube

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online

Tennessee Form Fae Qtax Quarterly Franchise Excise Tax Declaration 2021 Tennessee Taxformfinder

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Taxes Hardeman County Tennessee

How To Become A Tennessee General Partnership 2022

Don T Ignore Tennessee S Expanding Business Tax Nashville Business Journal

Tennessee Tax Services Purkey Carter Compton Swann Carter Pllc

Tennessee Cpa Journal May June 2015 Page 16

State Income Tax Law Changes For Q3 Of 2022

Amended Florida Corporate Income Franchise And Emergency Excise Tax

Tennessee State Tax Updates Withum

State Tax Changes Take Effect July 1 2020 Tax Foundation

Franchise Excise Tax Qualified Low Income Community Historic Structures Youtube

Fillable Online Tennessee Tennessee Department Of Revenue Franchise And Excise Tax Tennessee Fax Email Print Pdffiller